CEP Tracker: The Modern Brand Health Metric

Why It Matters

Traditional brand trackers measure:

- Awareness

- Consideration

- Imagery attributes

But they often miss a critical question:

Are you the brand that people recall at key buying moments?

The CEP Tracker addresses this by measuring mental availability across high-impact Category Entry Points (CEPs)—specific moments when consumers are most likely to engage with a category like energy drinks.

CEP Tracker Structure

1. Core Metrics to Track per CEP

Metric | What it Measures |

Unaided CEP Recall | % of people who name your brand first in a given CEP |

Aided CEP Recall | % who associate your brand when prompted with the CEP |

CEP-Brand Fit | How well your brand is seen as suited for that moment (1–5 scale) |

Likelihood to Use | Self-reported probability of choosing your brand in that CEP (1–5 scale) |

Competitive Salience | How your brand ranks vs. competitors in each CEP |

Distinctive Asset Triggering | Whether your assets (pack, color, jingle) are recalled in that context |

2. Survey Design Sample (per CEP)

Example CEP: "After a sweaty workout" (Energy drink context)

Q1. Unaided Recall

"Imagine you’ve just finished a tough workout and need to feel refreshed. Which drink brands come to mind?" (Open-ended)

Q2. Aided Recall

"Which of these brands would you consider in that situation?" (Select all that apply)

- Sting

- Red Bull

- Campa Energy

- Monster

- Thumps Up Charged

- Others: _______

Q3. Brand Fit

"How well do you feel [Brand X] fits this situation?" (1–5 scale: 1 = Not at all, 5 = Perfectly suited)

Q4. Likelihood to Use

"How likely are you to choose [Brand X] in this moment?" (1–5 scale: 1 = Very unlikely, 5 = Very likely)

Q5. Distinctive Asset Recall

"Which of the following brand visuals feel right for this moment?" (Show bottles/pack cut-outs/logos)

3. Reporting Output Example

CEP | Unaided Recall | Aided Recall | Brand Fit | Likelihood | Rank vs. Comp |

Post-workout refresh | 22% | 64% | 4.3 / 5 | 4.5 / 5 | #2 |

Late-night study session | 10% | 39% | 3.8 / 5 | 4.0 / 5 | #4 |

4. How to Use the Data

- Reallocate media: Target CEPs where relevance or recall is low.

- Identify white-space CEPs: Find unowned moments to dominate.

- Test distinctive assets: Refine creative development by CEP.

- Strengthen CEP-media-message match: Align campaigns to specific moments.

5. Add-on Metric: CEP Penetration Score

A composite index combining:

- Unaided + Aided Recall (weighted)

- Fit Score

- Share of mentions in CEP vs. category

Formula:

(Aided Recall × Fit Score × Usage Likelihood) / Weighted average normalized to 100

Use this as your Mental Availability Index per CEP.

Your Modern Brand Health Dashboard

Metric | Why It Matters |

CEP Penetration | Are we top-of-mind in real moments? |

Asset Recall by CEP | Are our visual codes working in context? |

Media-Moment Match | Are we spending in the right CEPs? |

White-Space Moments | Where can we lead the conversation? |

To better understand Category Entry Points (CEPs) and their impact on brand health, we are diving into a comprehensive CEP Tracker framework tailored for the energy drinks market.

CEP Tracker: ENERGY DRINKS – Full Build

Step 1: CEP Identification

CEP Name | Description |

Post-Workout Recharge | After gym, football, or intense physical activity — body fatigue |

Late-Night Study / Hustle | Late-night cramming, editing, hustling — mental alertness needed |

Gaming / Long Screen Time | Staying sharp during intense gaming or binge-watching |

Party / High-Energy Vibe | Re-energizing at a social event, party, or college fest |

Each represents a real moment of entry into the energy drink category.

Step 2: CEP-Specific Questionnaire

Each CEP follows a structured format:

CEP 1: Post-Workout Recharge

Context Introduction:

“Imagine you’ve just finished a high-intensity workout or sports session. You’re sweaty, tired, and need something that helps you bounce back.”

Questions:

- Unaided Recall:

“What are the first 2–3 drink brands that come to your mind in this moment?” - Aided Recall:

“Which of these brands would you consider after a workout?”- ☐ Sting

- ☐ Red Bull

- ☐ Campa Energy

- ☐ Monster

- ☐ Thumps Up Charged

- ☐ Others: _______

- Brand Fit (1–5 scale):

“How well do you feel each brand fits this moment?”

[Brand X]: 1 (Not at all) – 5 (Perfectly suited) - Likelihood to Use (1–5 scale):

“How likely are you to choose [Brand X] in this moment?”

1 (Very unlikely) – 5 (Very likely) - Triggering Asset Recall:

“Which of the following visuals/pack colors/logos do you associate with this moment?”

(Show bottles/pack cut-outs/logos) - Reasons for Choice (open-ended):

“Why would you choose this brand after a workout?”

CEP 2: Late-Night Study / Hustle Mode

Context:

“Think about a late night where you’re studying, editing videos, coding, or finishing up work. You’re tired, but you need to stay focused.”

(Same question format as above)

CEP 3: Gaming / Long Screen Time

Context:

“You’re deep into a gaming session or watching a long show, and want to stay sharp, focused, and in the zone.”

(Same question format)

CEP 4: Party / High-Energy Vibe

Context:

“You’re at a house party, college fest, or music night. You feel your energy dipping and want to feel that spark again.”

(Same question format)

Step 3: Output Metrics (per Brand per CEP)

Brand | CEP | Unaided Recall | Aided Recall | Fit Score | Usage Likelihood | Rank |

Sting | Post-Workout | 34% | 76% | 4.6 | 4.5 | 1st |

Campa | Study/Hustle | 12% | 52% | 3.9 | 4.0 | 3rd |

Red Bull | Gaming | 28% | 69% | 4.7 | 4.6 | 1st |

Step 4: CEP Penetration Score (Per Brand)

Formula:

(Aided Recall × Fit Score × Usage Likelihood) / Weighted average normalized to 100

Use this to track:

- Mental availability by moment

- Media planning alignment (target weak CEPs)

- Creative asset linkage (are brand visuals working per CEP?)

Step 5: Advanced Uses

- Layer in ad exposure recall:

“Have you seen ads from any of these brands in this kind of moment recently?” - Add CEP discovery module:

“In what other moments do you typically consume energy drinks?” (Open-ended, coded for new CEPs)

Things to think about:

- Rotate in new CEPs based on cultural trends, campaigns, or seasonality.

- Combine quantitative data with social listening to identify emerging moments.

Featured Blogs

TRENDS 2024: Decoding India’s Zeitgeist: Key Themes, Implications & Future Outlook

How to better quantify attention in TV and Print in India

AI in media agencies: Transforming data into actionable insights for strategic growth

How the Attention Recession Is Changing Marketing

The New Luxury Why Consumers Now Value Scarcity Over Status

The Psychology Behind Buy Now Pay later

The Rise of Dark Social and Its Impact on Marketing Measurement

The Role of Dark Patterns in Digital Marketing and Ethical Concerns

The Future of Retail Media Networks and What Marketers Should Know

Recent Blogs

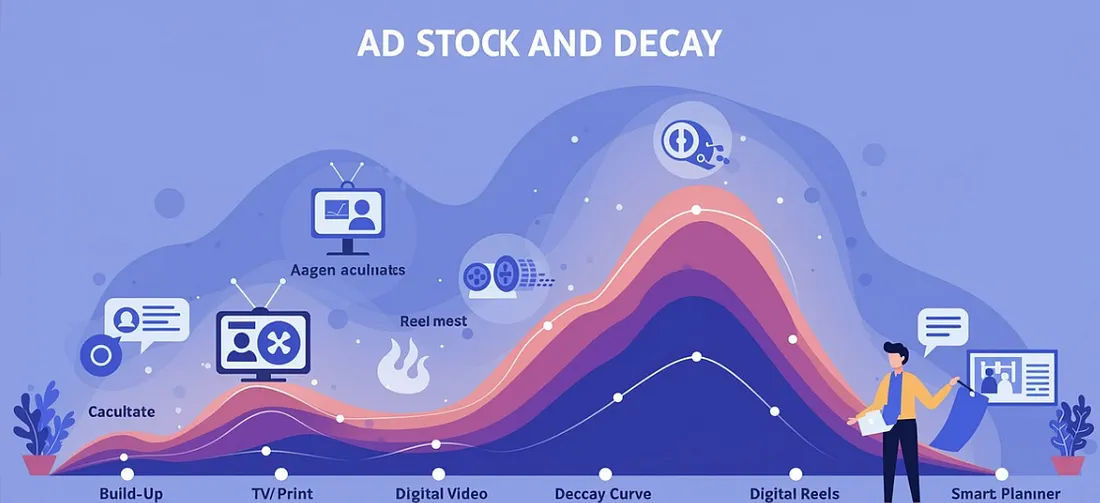

Ad Stock & Decay: The Invisible Hand Guiding Media Schedules

The Big Mac Illusion:What a Burger Tells Us About Global Economics

When Search Starts Thinking How AI Is Rewriting the Discovery Journey

CEP Tracker The Modern Brand Health Metric

Cracking Growth: How to Leverage Category Entry Points (CEPs) for Brand Advantage